Last month we announced a new funding round for Tettra. I’ll admit, it feels really great to be able to tell the world that we closed more money. Especially after nearly going out of business last year. I’ll also admit that raising it was a ton of work.

Reading funding announcements from other startups makes it seem like it’s easy to raise money. It’s not. Paul Graham said it best in 2008, and his words still hold true today:

“Raising money is the second hardest part of starting a startup. The hardest part is making something people want: most startups that die, die because they didn’t do that. But the second biggest cause of death is probably the difficulty of raising money. Fundraising is brutal.”

Luckily, there’s been a ton of advice shared about how to fundraise since then. Here are some of my favorite posts on how to get a round done:

- A Guide to Seed Fundraising by Geoff Ralston of YCombinator (2016)

- How to Raise a Seed Round by Justin Kan of Atrium (2018)

- A Fundraising Survival Guide (2008) and How to Raise Money (2013) by Paul Graham

Instead of the usual post with tips on how to fundraise, I wanted to to give some insight into what our fundraising process actually looked like and how long it took.

In total, we’ve raised $1,521,000. We raised $931,000 in April 2016 and another $590,000 in October 2018. Comparatively, the second round was much harder than the first, but both were tough. Honestly, fundraising is never easy.

Let’s break down the second round now.

193 days: Sharing all the details of the raise

We sent out the first email on 4/19/2018 and got the last wire transfer on 10/29/2018. That’s 6 months and 10 days from start to finish.

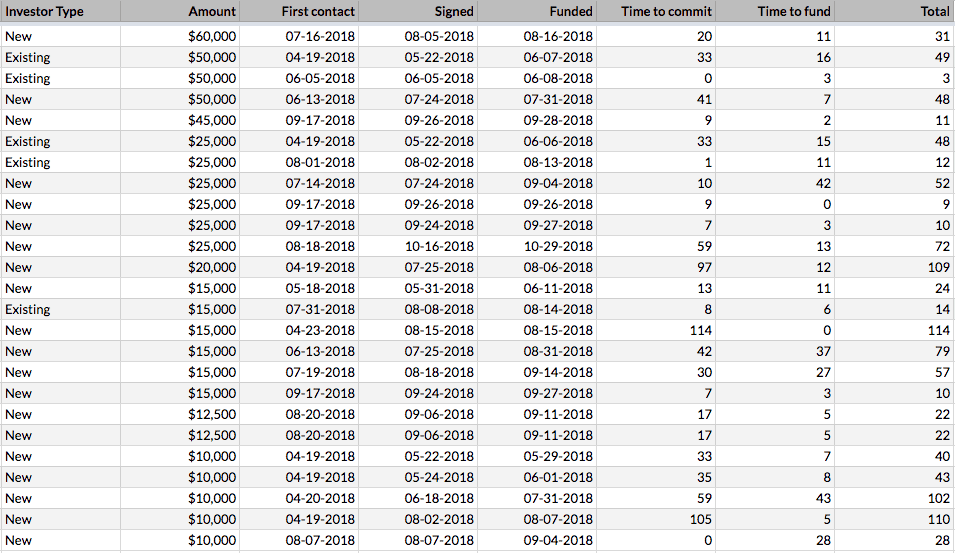

Here’s a table of how long it took from initial reach out to commitment and ultimately receiving the funds for every investor we closed.

It took 33 days from our initial outreach to getting our first commitment, and another week to close the funds from that investor. Interestingly, this person co-founded one of the fastest growing SaaS companies of all time. I used that social proof to then close a few of our existing investors who previously had shown interest in making a follow-on commitment.

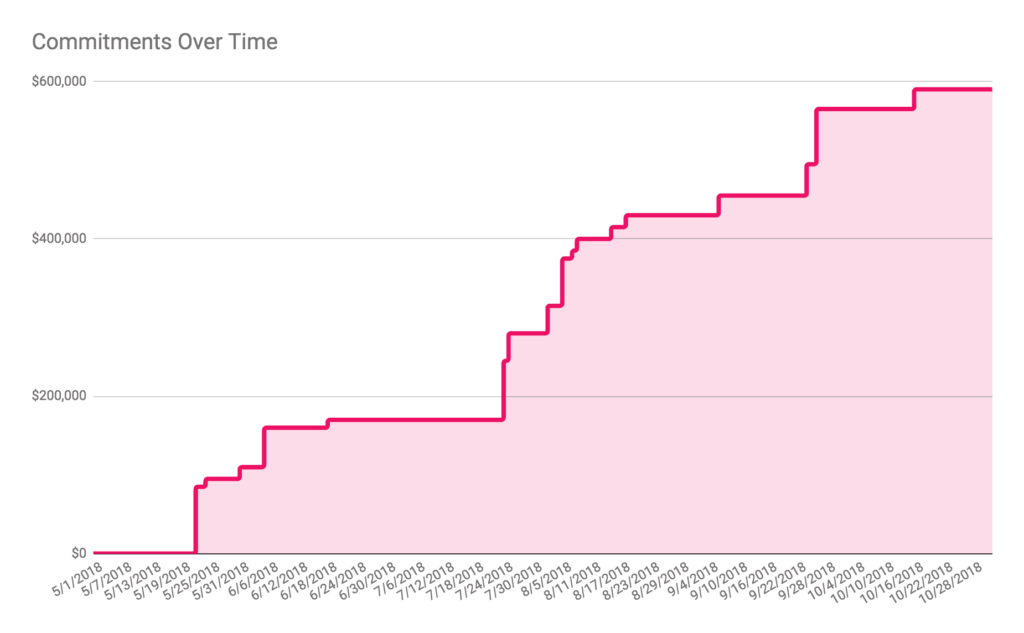

We started off strong but then hit a wall in the beginning of June. You can see it at the beginning of the chart below.

Luckily, the same thing had happened to us while raising our first round, so I knew not to let it worry me too much. I also realized that fundraising over the summer can be tough, since many people take longer vacations. The important thing to remember when fundraising is that you need to stay the course.

Eventually at the end of July we got another $50,000 commitment from an investor who co-founded one of the world’s largest tech companies. That reignited our momentum and helped us close some new investors.

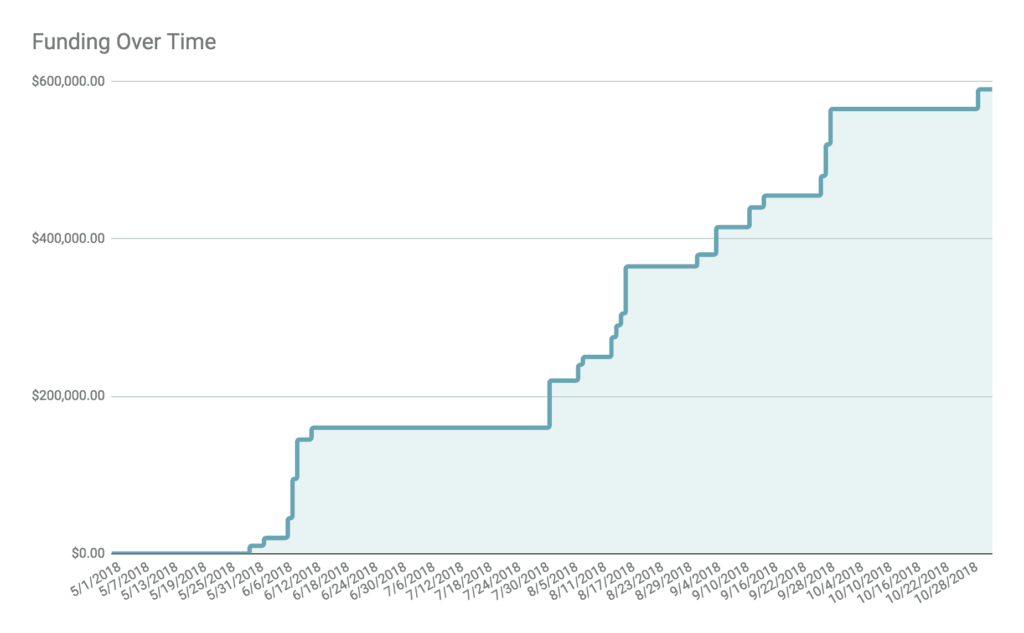

By the end of August, we reached our goal of $400,000 and ultimately oversubscribed to $590,000 over the following two months. Here’s a chart of when all the money closed:

Stats on stats on stats: Other interesting data points

Here are some other interesting data points and stats about the fundraise.

Success rate

We contacted 75 different investors. Out of those, we got 25 commitments and 50 rejections for a 33% success rate.

We sent 1,482 emails, did 4 meetings over the phone, and had 29 meetings in person.

New investors vs. existing investors

We had a good balance of new investors, as well as money from previous investors. Out of our 25 investors in this round, five of our existing investors followed on with a second investment, and the other 20 investors were all new to Tettra.

To me, this signals that we’re doing a good job communicating with investors and they still believe in the vision of the product. 28% of the $590,000 round came from existing investors and 72% came from our new investors.

On average, the existing investors wrote larger checks at $33,000 vs. $20,000 for new investors

Where our new angels came from

Here’s the breakdown of how we met each of our 20 new angel investors:

- 2 came from intros from our existing investors

- 3 were previous co-workers at HubSpot

- 5 are other founders we’ve built relationships with over the years

- 1 backed my previous startup (Rentabilities)

- 1 came from an intro from one of our Tettra teammates

- 2 came from an intro from an investor who passed (it surprised me this actually worked)

- 6 were intros from new investors after they committed

Rookie angels

Two of our new investors are first-time angels. It’s good to remember that even if someone has never made an investment before, it’s still good to ask because they might be interested in backing you.

Founder friends

Six of the new investors are what I call “founder friends”, meaning these are other founders we’ve gotten to know over the years who decided they wanted to invest in us. Interestedly, these “founder angels” are some of our most helpful because they’re actively running companies near or slightly ahead of our stage and can offer relevant, relatable advice.

Time to close

The shortest time from initial contact to closed funds was 3 days. However, this was an existing investor who read our investor update and decided to commit another $50,000 without me reaching out.

For new investors, the fastest time from outreach to close was 9 days, and the longest was 114 days.

The average time from paperwork signed to getting the money in the bank was 13 days and the median time was 8 days. Two investors funded the same exact day they signed the paperwork.

Types of funding

We received 20 wire transfers and 5 paper checks for the funding. We had a 40% error rate with the checks. One of them got lost in the mail because I forgot to alert the investor that we moved offices. The other was too illegible for remote deposit and I had to send it through certified mail to our bank for manual deposit.

Location

88.1% of the round came from investors in the Greater Boston area, 10.2% came from the Bay Area, and 1.7% came from Remote investors. The heavy skew towards Boston is probably partly because investors tend to invest locally and partly because my network concentrates in Boston.

Lessons and takeaways

There’s a ton of tactical advice on how to fundraise, so I won’t dive too deep. But here are some strategic conclusions that might prove helpful to other founders:

Fundraising is a long slog. Brace yourself.

When we stared this round I thought it might take me three months. It took over six. Fundraising always takes longer than expected. Be ready to grind it out and keep going for a long while.

Send investor updates if you have existing investors

This was our second round. In hindsight, one of the best things we did to set ourselves up for success for this one was sending investor updates every month to our previous investors. Because our previous investors had context around our journey from nearly failing to profitability, they were more comfortable giving us additional funding. One of our investors even said this to me after committing another $15,000:

“I admire your tenacity and commitment. Make us proud!”

It’s important to be transparent at all times. In the good times, your investors will celebrate with you. In the bad times, they’ll try to help you get things right. The worst is being opaque, then showing up with your startup on fire and no explanation. My #1 piece of advice to new founders would be to send an investor update every month. Not only does it engender support and confidence, but it also keeps you honest by forcing you to reflect on how you’re really doing.

Sign up here to get our template that we send to investors every month.

Build relationships before you need to raise

30% of the investors we closed this round were pre-existing relationships—either people we worked with at HubSpot or founder friends we’d built a relationship with over years. As Mark Suster says, people invest in lines, not dots. It’s important to start building relationships well before you plan to raise. This doesn’t necessarily take a ton of time. Just make sure to keep people who might be good investors updated with exciting news, ask for help where it makes sense, and craft a genuine relationship with them. When the time comes to seek investment, they’ll be much more likely to say yes.

Keep the pipeline loaded, stay organized, and follow up

Fundraising is a sales process. As with any sales process, you want a full pipeline at all times. During the occasions when I neglected the top of our pipeline, our momentum really slowed. Momentum is a powerful tool in fundraising, and by reaching out to a lot people constantly, you can create the momentum you need. I’d recommend scheduling a few hours every day to do reach-outs and follows-up.

Of course, momentum is only as valuable as your ability to control it. You need to stay organized and stay on top of your pipeline at all times. We used Trello to keep track of each deal and Boomerang to follow up. Trello was useful for keeping track of who was where in the deal process. Boomerang was a useful source of discipline in terms of timely follow-ups.

A fundraising specific tool like FounderSuite or even Asana would work too. The important thing is staying organized and top of each deal. There’s also an added bonus that your co-founder or team won’t ask you what’s going on with fundraising all the time. They can just check the board.

Leverage each commitment as a way to build momentum and social proof

Whenever a new investor committed, I updated those still in the pipeline. This is a powerful technique because it taps into fundamental human psychology of social proof and FOMO. People don’t want to miss out on a good investment that other smart people are making. Looking at our charts above, you’ll notice that funding rounds tend to act like a snowball rolling down a hill. At first your snowball is small and rolls slowly. But as it picks up steam and gets bigger, you’ll have more momentum and each roll grabs more snow. Fundraising rounds are no different. At first, they’re slow, but towards the end they pick up speed and close out fast.

It’s never a deal until the money’s in the bank

For both of our rounds we used a rolling close, which means we collected the funding from each individual investor as they committed. If you’re raising from angel investors and are collecting money from a lot of different people, I highly suggest using a rolling close if you can make it work. Collecting each check as it’s committed is much easier than trying to wrangle dozens of people all at once in a specific timeframe.

At Tettra, we’re lucky to have avoided any issues with investors committing and then reneging. In talking with dozens of other founders, I’ve learned that investors back out all the time — even ones who have signed the paperwork. It’s important to remember that it’s never a deal until the money is in the bank.

Finally, thanks to all our amazing investors

Lastly, I want to thank all the investors who have backed us in both this round and the last one. We wouldn’t be where we are now, helping thousands of companies around the world grow and thrive together, without their help.

Alison Elworthy, Andrei Oprisan, Andrew Bialecki, Andrew McCollum, Brian Halligan, Brian Shin, Companyon Ventures, David Cancel, Des Traynor, Dharmesh Shah, Diane Hessan, Ed Roberts, Elias Torres, Jay Meattle, JD Sherman, Jere Doyle, Jessica Meher, Jim ONeill, Jo Tango, Joel Gascoigne, John Kinzer, Joshua Porter, Kannan Sockalingam, Ken Morimoto, Kyle York, Laurent Drion, Mark Pui, Mark Roberge, Matt Daniels, Franklin Foster, Matt Engel, Max Faingezicht, Meerie Joung, Mike Champion, Mike Volpe, Myisha Frazier, Paul English, Ryan Burke, Tarun Rathnam, Timothy J. Hosek, Tom Copeman, Uri Mariash, Vic Polk, Vinayak Ranade, Waikit Lau, and Will Perkins.

Thanks for reading!

That’s all, folks! Thanks for reading and making it to the end. If you have any questions, feel free to reach out to us over chat or email me anytime: [email protected].

Cheers,

Andy

P.S. If your startup is growing and you’re looking for an internal knowledge sharing & management system (aka a wiki), checkout our product Tettra now.