Welcome to our series chronicling our journey from nearly failing to profitability. Make sure to read all four parts:

Part 1: A brewing storm

Part 2: Righting the ship

Part 3: Land ho!

Part 4: Charting a new course.

If you’re all caught up then subscribe to get updates from Tettra.

How we planned to get out of this mess

At our quarterly company meeting at the end of June ‘17, I outlined our new survival plan: get to profitability.

The plan was pretty simple. We’d need to cut expenses and grow revenue. In essence, it was time for Business 101: Revenue – Expenses = Profit. We needed to build a real business, and fast.

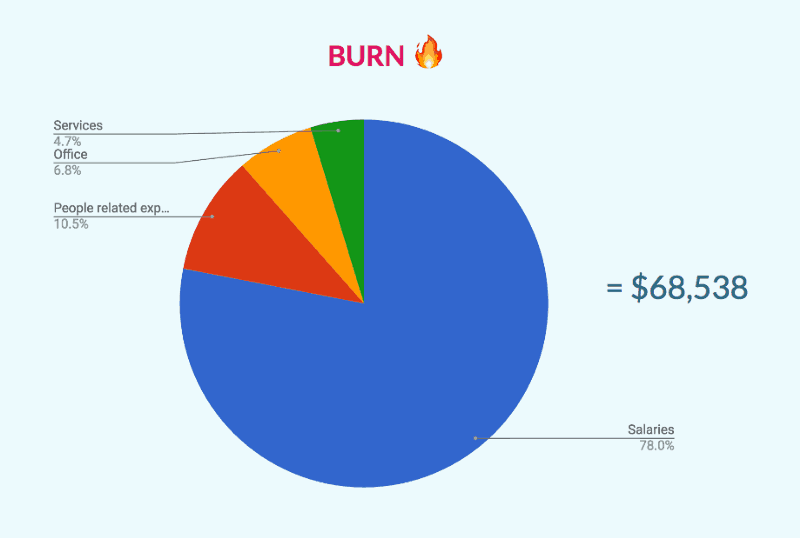

The numbers were tough to swallow. Our MRR was $12,686 and our monthly burn was $68,538. Those two lines would need to intersect before we ran out of money.

Feelin’ the burn

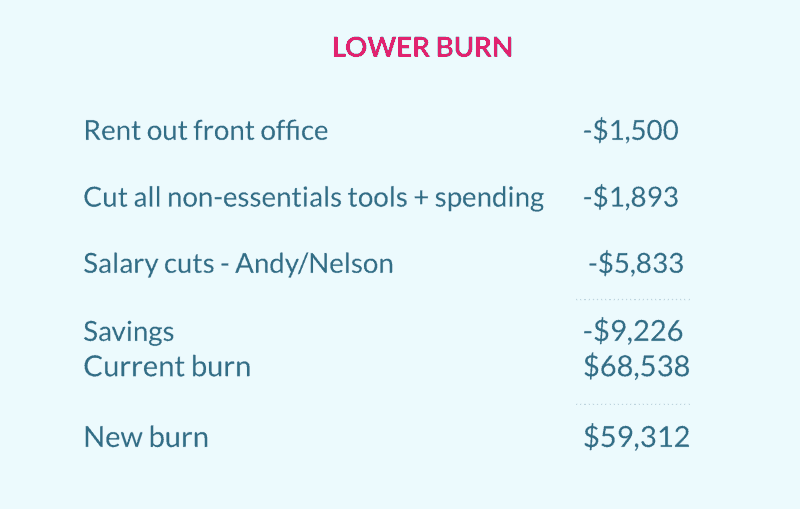

The easiest cuts to make were non-essentials tools ($1,893/mo) and renting out part of our office to another company ($1,500/mo). More challenging personally was that both my co-founder and I were cutting our salaries down to zero ($5,833/mo). In a startup, the founders eat last. That cut our total burn by $9,226.

Even with these cuts, we were still running a $46,626 deficit. The easy decisions wouldn’t be enough.

More MRR

The next piece of the plan involved dramatically increasing our MRR growth. MRR growth over the previous six months was pretty much flat, and in June we actually trended down coming in at $954 net new MRR.

At the time, we charged $5 per user for the product. Our average contract value was $600. This was far too low to support a full-time inside sales model. To make sales really work for us ACV would need to be at least 4x that amount.

The biggest lever to pull to quickly make progress was to change the pricing model. Plans went from a fluid per-user model to a “tiered” plan model ($50/150/250/500) based on team size. This would help justify the initial acquisition cost and generate more revenue upfront rather than waiting for each user to be added one by one.

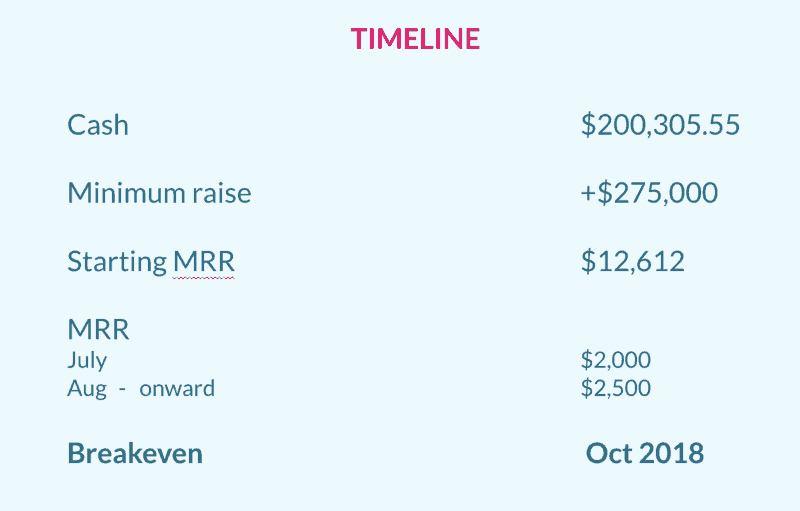

Our goal for July was to add $2,000 in net new MRR, then at least $2,500 each month after that.

More Cash

To keep the team at full strength, we’d also need to raise more money to bridge us to profitability. I’d tried to raise a seed round with no success, but an inside round from our existing angel investors seemed more realistic.

Nothing is ever easy in startups. It turned out to be a lot harder than I imagined to raise a small round when against the ropes, which I’ll dig into more in the next part of the series.

More Clarity

Finally, I made sure to spend some time explaining to the team that just because we weren’t following the “traditional startup path” by raising venture capital didn’t mean we weren’t still on the path to building a big, impactful business. We just planned to do it in a sustainable, revenue-driven way.

Raising venture capital is like taking steroids for a startup. You get big fast, but it’s usually unhealthy and unsustainable. Instead, we’d build real muscles for growth by working hard over time. Realistically it’d probably take longer to reach our goals. The good news was that when we did, we’d have the right habits and a sustainable foundation to grow fast in the future.

This might seem like an obvious way to build a company to people outside the tech industry reading this (hi mom!), but this is the “untraditional path” nowadays for startups.

The reality is that not raising VC is the correct path for a majority of organizations and there’s no shame in building a real business. Companies like Atlassian, MailChimp, Basecamp, SurveyMonkey, Grammarly, Wistia, Zapier and plenty of other hugely successful companies that impact millions of people around the world all got to where they are without raising venture capital.

We could follow the same trajectory. We had all the ingredients to be a huge success — an ambitious and talented team along with a product that customers loved. We just needed more time to figure out how to launch our rocket ship. The way we’d do it was by building up our revenue-making muscles instead of trying to fuel our growth with VC steroids.

Everyone has a plan…

So the plan was to keep expenses down, change prices to grow faster, and raise $250,000 more to sustain the team. With all these changes, we thought we could be profitable by October 2018. But that’s not exactly what happened… Want to know what did?

Continue on with the story in Part 3: Land ho!