Ahoy there! Welcome to the fourth and final post of our series chronicling our journey from nearly failing to profitability.

Welcome to our series chronicling our journey from nearly failing to profitability. Make sure to read all four parts:

Part 1: A brewing storm

Part 2: Righting the ship

Part 3: Land ho!

Part 4: Charting a new course.

If you’re all caught up then subscribe to get updates from Tettra.

When you ask a startup founder how they’re doing, the usual answer goes something like this: “Everything’s amazing. We’re crushing it. Things couldn’t be better.”

But the truth is that most startup founders aren’t actually telling the truth about how they’re doing. Reality looks something more like this:

A little less than a year ago, I was this dog, sitting in flames trying to save Tettra. Our business model wasn’t working and our burn was too high. At our lowest, we had two weeks of cash left in the bank and we were on the brink of failure. Luckily, we made the right decisions and reached “profitability” before our company burned down.

Back in black

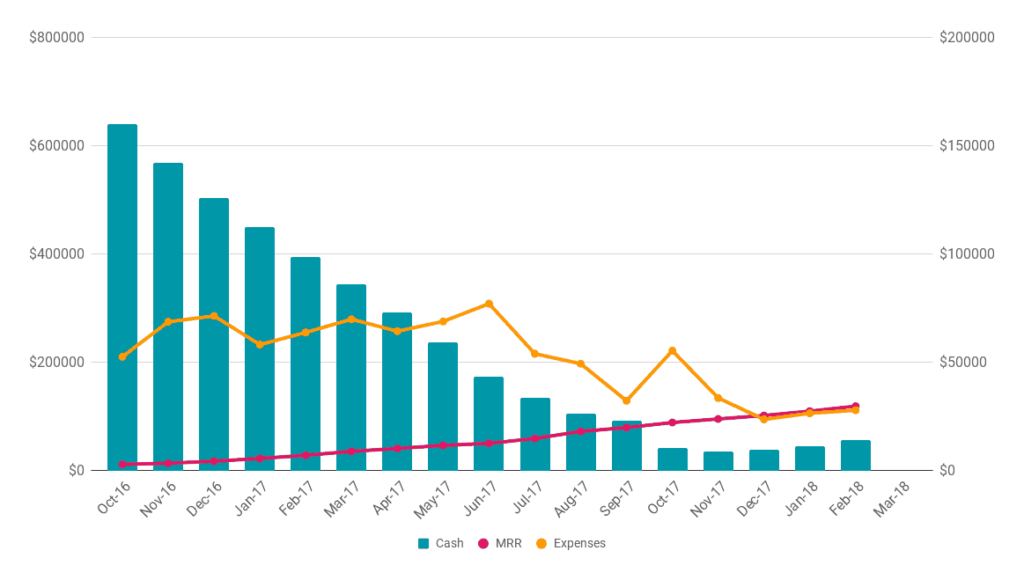

Getting into the black for the first time in December 2017 immediately decreased my stress levels. Our burn rate was no longer eating up all the oxygen in the room and I finally felt like I could breathe again.

But that feeling was short lived because our “profitability” wasn’t exactly sustainable. Both myself and my co-founder hadn’t taken salaries for nine months and were still living off our savings. Our remaining team members were all on pay cuts too.

The company wasn’t at risk of burning down anymore, which I was thankful for, but it was highly likely our team would still burn out. We needed to do something about our cash situation, and fast.

Solving our immediate cash problem with debt financing

When we hit profitability, we had $45,152 left in the bank. Our monthly expenses were $26,561. You never know what’s going to happen in a startup, but you can generally count on some unexpected risks. We knew we needed more money to give us a margin of error to withstand these risks.

Even though we were profitable, trying to close more funding in a short timeframe seemed unlikely because fundraising usually takes months. Instead of raising money, we turned to an often-underused option by startups: debt financing.

Debt financing is different than the usual path of equity financing. With debt financing, you take on a loan that gets paid back over time with interest instead of selling shares that get paid back when the company exits.

You might be wondering why a company would choose to work with debt financiers, rather than take a small business loan. The reason we used debt financing over a normal bank loan is because it would be pretty much impossible for Tettra to get a bank loan: we’re a high-risk software startup with no collateral, lead by founders without any real wealth or assets that could be used to make a personal guarantee.

Over the years, I’d heard about a firm called Lighter Capital. The interesting thing about Lighter Capital is that they specialize in debt financing for early-stage SaaS startups. They understand the predictability of recurring revenue and don’t require collateral or a personal guarantee for a loan to the company. Tettra seemed like a great fit for their financing model.

Through a mutual friend, I was able to get a referral to one of the members of the investment team at Lighter Capital, and we hit it off. Ultimately, we decided to put Tettra through their diligence process to apply for funding.

The process was surprisingly fast and painless. The application took about a week to complete, after which, they offered us a $75,000 loan and transferred the funding within three weeks. If you’re a revenue-driven business looking for some extra growth capital, Lighter Capital is a great option to consider.

To raise or not to raise, that is the question

Seeing the wire clear from Lighter Capital was a huge relief and gave us some much needed time to think about how to get to a more sustainable place, financially. We knew we had two options: 1) try to grow revenue fast enough to increase every one’s salaries or 2) raise more money to bridge our salaries in the short term while we worked to grow revenue over the longer term.

We would have preferred the first option, but, realistically, we couldn’t make it work. My co-founder and I needed to start taking salaries again because we were running out of personal savings. We also needed to bring our teammates’ salaries back up because we had promised the pay cuts would only last six months and were coming up on that deadline. We decided to make the time tradeoff to raise a new funding round.

The first part of any fundraise is figuring out the terms. We raised our first round on a normal SAFE, but this time around we discussed using an alternative funding structure that better aligns with long term profitability than a convertible note. Notably, we explored the open-sourced Indie.vc terms which stood out to us as one of the best options out there.

Indie.vc’s terms are interesting for companies that want to forgo the traditional venture-backed path of raising money every 12-18 months. What makes them different is that they have a built-in payback minimum of 3x the investment which you start paying three years after taking the money, along with an equity stake. These terms allow investors to get some liquidity without putting pressure on the company to raise another round or exit. This allows the company to continue to grow and every one’s happy.

Another interesting option that presented itself around this time was the set of terms published by the SparkToro founders, Rand Fishkin and Casey Henry. The gist is that investors, founders, and employees can get paid back via dividends over time which aligns every one for a long-term profitable future. These are different from the Indie.vc terms because the payback period and amount isn’t predetermined. This allows the company the option to continue to invest in growth, or pay dividends to the stakeholders, which is useful. You can access the term sheet and read more about SparkToro’s Unusual Round of Funding on their blog.

Ultimately we decided to use a traditional SAFE with a $6.5m cap and 20% over something new. The reason we made this choice over using the other terms is pretty simple. Getting an investor to say yes to investing in your startup is a huge challenge. Getting them to understand and agree to an unfamiliar funding structure makes fundraising even more challenging. You can think of it like trying to run a marathon with a backpack full of weights. Sure, you might be able to pull it off, but isn’t running a marathon hard enough? My hunch is that as Indie Businesses gain more steam, alternative funding structures will become more commonplace, and more investors will be willing to use them without much convincing. Until then, we took the path of least resistance.

Whatever terms you use, you should think hard about the tradeoff of time vs. money when deciding to raise a round. Too often, entrepreneurs fall into the trap of feeling like they’re not a real startup if they haven’t raised funding. Founders often measure their company’s progress, and even their own self worth, by how much money they’ve raised.

Early on, we decided we wanted to be an Indie Business that made money from the start and measured ourselves off revenue. We used funding as a tool to get us off the ground, but we aspire to grow on our own steam. Admittedly, we’ve been tempted to raise larger rounds of institutional capital along the way, and even got close to getting some term sheet offers which we decided to forgo. But I’m glad we’re constrained right now because it has forced us to focus on building long-term value for the the most important stakeholders in our business: our customers.

Fueling up the ship

It’s been a long journey full of ups and downs over the last year. I’ll admit, the downs were hard to handle, and I wouldn’t have been able to make it without the support of my team, investors, my family, and my fiancé. Fortunately, today we have some good news to share: we closed a round of $590,000 to help us invest more in features and integrations that will supercharge our customers’ businesses.

The amount is kind of weird and wasn’t deliberate. We were targeting $400k as our minimum and decided to oversubscribe it a bit to give us more runway. If you can get extra money while raising, it’s usually a good idea to take it.

We’ll write a more detailed post in the near future breaking down the round and how we got it done. To get updates when that post launches, subscribe here.

The quick summary is that the round took most of my time and mindshare from May to September to raise. We talked to dozens of investors on the phone or in person, and reached out to even more.

28% of the round of the round came from existing investors. Most of our investors following on said they were giving us more money because they admired our grit and vision for how the product could impact people’s lives. I’m hugely proud to have some of our existing investors backing us again because it’s a vote of confidence from the people with the most context on our business and us as founders.

As a quick aside, the follow-on funding from existing investors made closing new angel investors much easier. Every month, we send out an investor update. I think our transparency when things were bad and our ideas for the path forward were big reasons why many of our past investors gave us more money. If you’re a founder, I highly recommend taking the time to keep your investors in the loop. When shit hits the fan, (and it inevitably will,) people are more willing to help if they know what’s going on. We have an investor update template we’ve refined over the years that makes updates seamless to send out. Sign up here and I’ll send it to you.

The other $425k of the round came from new investors in Tettra. $145k of that was from people I’ve gotten to know over the years including one of my investors in my first startup, Rentabilities. The rest of the round, $280k, came from people I met solely for this round. 100% of the money came from warm intros. All together, we added 19 new investors to our cap table.

Thanks to our amazing investors

We’d like to say thank you to all the people who gave us their vote of confidence by investing in us. The following is not a complete list because some people asked to remain private, but this is most every one who backed us in this round, in no particular order:

Andrew Bialecki, Will Perkins, Tom Copeman, Guy Johnson, Jo & Beth Tango, Matt Daniels, Franklin Foster, Victor Polk, Joel Gascoigne, Waikit Lau, Mike Volpe, Companyon Ventures, Tarun Rathnam, Jim O’Neill, Kyle York, Joe Raczka, Vinayak Ranade, Josh Porter, Andrew McCollum, Alison Elworthy, Max Faingezicht, Jay Meattle, Dan Faingezicht, Des Traynor, Avy Faingezicht, JD Sherman, Meerie Joung, and Ed Roberts.

Thank you all for your support 🙌

Funding is a tool: here’s how we plan to use it

Closing this funding and telling the world feels great, especially given how close to failure we were a year ago. Adding this round to the initial $906,000 we raised in April 2016 and the $25,000 bridge round we raised at the end of last year, our total funding amount is now $1,521,000. As someone who grew up in a middle-class household, this seems like a ridiculous amount of money, and even writing out that number feels weird. But comparatively to other startups in general and most of our direct competitors, it’s a small amount.

No matter the amount, funding announcements always feel funny to me. It’s like celebrating a chef for collecting the ingredients to a meal. They did some work and got what they need to cook a great meal, but they could still burn it. As a team that almost burned up once, we’re making sure we don’t end up in the same place. We’re spending this money to build the best possible product in a responsible way: one that can change the entire co-operating system of our customers’ businesses.

Already, this funding has allowed us to do some things we otherwise would not have done. We launched a free version of our product, despite the known risk that it could tank our revenue in the short term. We believe a freemium model is the right long-term choice for a product like ours, where you have to invest time to get value. Already, we’ve seen 2x growth in our daily signups. Admittedly though, making that switch and seeing the hit to new revenue is scary. We had one of our worst months of new MRR growth ever in September. Fortunately, this new funding takes some of that pressure off, and we’re confident the freemium change will make for a stronger business in the future.

We’ve also stepped on the gas with our product. We launched a 2.0 version of the product and leaned into new features that make our customers’ lives easier and their teams more successful. This includes integrations with Google Drive, GitHub, and Zapier. Thanks to this funding round, we’re even growing our engineering team for the first time in over a year and a half. We’re powering up in all places to continue to build the integrations and features that differentiate our product.

The road less traveled

There’s a movement happening right now, especially in the B2B SaaS world. It’s the rise of Indie Businesses.

What makes an Indie Business? My definition is pretty simple: It’s a company that wants to remain independent indefinitely. They do this by being profitable and focusing on customers as the primary stakeholders that fund their business.

You’ve probably heard of a few companies that grew with the Indie ethos — Mailchimp, Basecamp, Atlassian, Wistia, Buffer, Zapier, and many more. These companies have chosen to combine profit with patience to achieve success. Ironically, by not raising a ton of funding and instead embracing capital constraints, many of them are now the leaders in their markets. They’ve built more efficient, healthy, and successful businesses than their VC-backed counterparts.

At Tettra, we believe in efficiency and the Indie Way. One of the best compliments I receive as a founder is when I tell people we’re a team of five and they incredulously respond, “Wait, seriously? I thought you had way more people.” We punch above our weight class, and I’m proud of that. More funding and more people doesn’t necessarily mean more progress. For us, our small size is an advantage. We’re able to work nimbly and can optimize for our customers over any one else. Focusing on delighting our customers has served us well and we want to continue doing just that, even if it means sacrificing growth sometimes.

The interesting thing about SaaS is that it doesn’t seem to actually be “winner take all.” In the marketing automation space, there have been multiple $1B+ businesses — HubSpot, Marketo, and Mailchimp — and a host of other smaller companies growing crazy fast like ConvertKit. In our market of cooperative knowledge management software, there’s room for Tettra and probably a dozen other big companies. This isn’t Highlander — there can be more than one.

Our goal with this round is to get back to profitability, then keep growing to continue to build the best possible product, brand, and culture. That doesn’t mean we’re a Lifestyle Business either. Far from it. We have big ambitions and believe we can build a big business. We just don’t want to get there unsustainably by injecting our company with VC steroids. Instead, we’re being patient and doing the work to build the real muscles of sustainable growth. In time and with patience, we think we’ll be stronger, more efficient, and have the grit to outlast everyone else.

Nowadays whenever I’m catching up with someone and they inevitably ask how Tettra’s going, my answer is usually the same — “Pretty good. We haven’t fail yet, so that’s a win.”

It might sound like a cheeky reply, but I’m actually very proud we haven’t imploded.

The vast majority of startups fail, many within the first three years. A few weeks ago we beat the odds and celebrated our three year anniversary of starting Tettra. We’ve outlasted the death clock thus far and plan to continue to not only survive, but thrive, by being sustainably profitable.

Looking back it’s been quite the ride with the journey full of ups and downs. I’m excited for the next three years and can’t wait to look back in the future on all the progress and memories we’ve made, and most importantly, the companies we’ve helped grow and thrive together.

If you’re curious how the next three years go and want to hear more lessons from us as we build our Indie Business, subscribe below for updates. Thanks for reading and all your support. Onward!